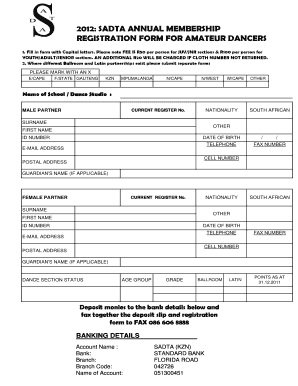

India Max Life Insurance Nationalized Electronic free printable template

Show details

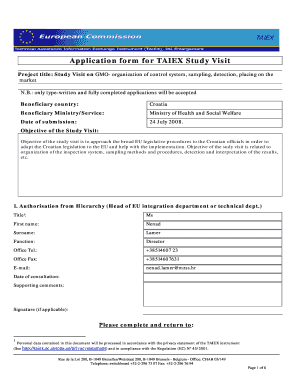

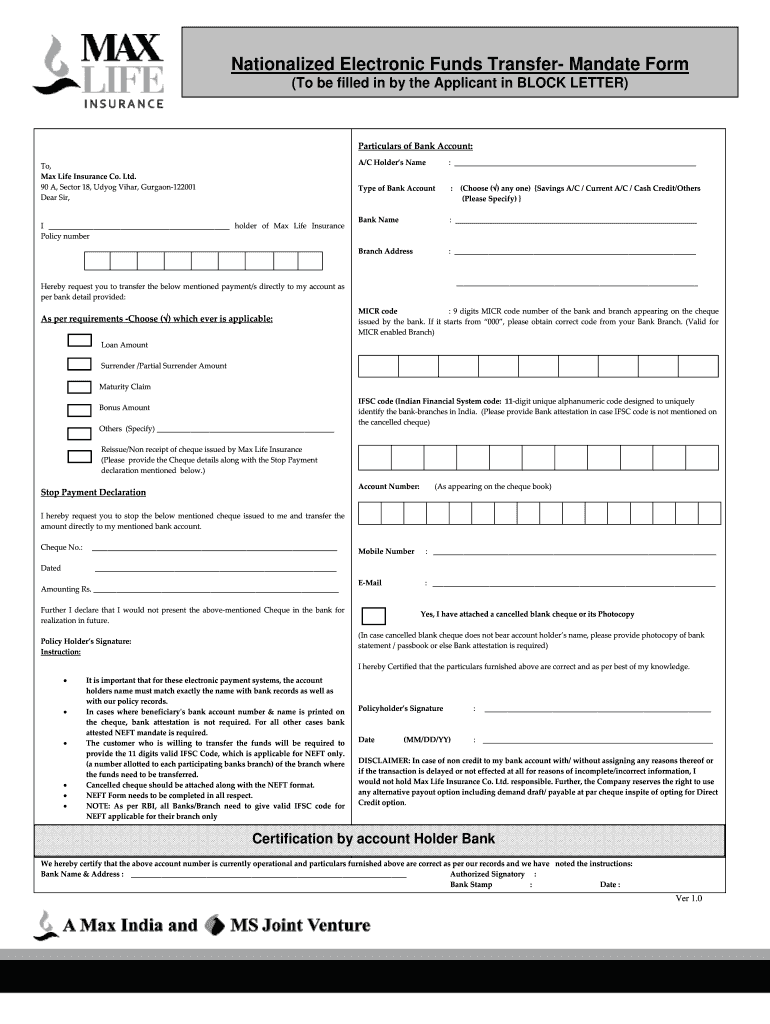

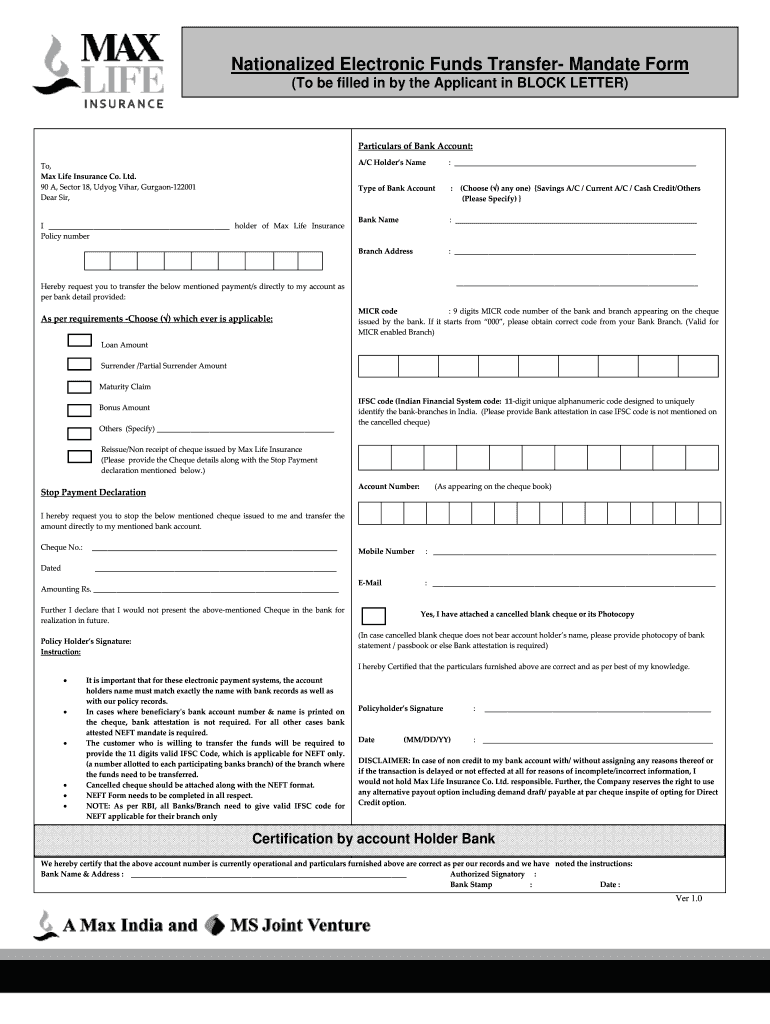

NEFT Form needs to be completed in all respect. NOTE As per RBI all Banks/Branch need to give valid IFSC code for NEFT applicable for their branch only MICR code 9 digits MICR code number of the bank and branch appearing on the cheque issued by the bank. If it starts from 000 please obtain correct code from your Bank Branch. Valid for MICR enabled Branch IFSC code Indian Financial System code 11 digit unique alphanumeric code designed to uniquely identify the bank branches in India....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign max life insurance online payment form

Edit your life insurance funds transfer mandate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your max life insurance form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing required documents and information filling out the is crucial to avoid delays in processing online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit life insurance form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out max life insurance form

How to fill out India Max Life Insurance Nationalized Electronic Funds

01

Obtain the India Max Life Insurance Nationalized Electronic Funds application form from their official website or nearest branch.

02

Fill in your personal details, including name, contact information, and address.

03

Provide your identification details such as Aadhar number or PAN number.

04

Select the insurance plan you wish to apply for and specify the coverage amount.

05

Fill out the payment details, including bank account information and payment mode.

06

Review all information to ensure accuracy and completeness.

07

Submit the completed application form along with necessary documents to the designated authority.

Who needs India Max Life Insurance Nationalized Electronic Funds?

01

Individuals seeking financial security for their families in case of unforeseen circumstances.

02

People looking for a way to save and invest for future needs.

03

Those who want a comprehensive insurance plan to cover critical illnesses and other significant expenses.

Fill

india max life electronic funds edit

: Try Risk Free

People Also Ask about neft form needs to be cheque issued by the bank

How do I change my ECS details on Max Life Insurance?

You can change the ECS debit date by giving a written request at your nearest Max Life Insurance branch, 15 days before your initial debit date to avoid double debit from your account. Available bill draw dates in a month are 1,4,8,12,16,20,23 and 27.

How do you surrender in Max Life Online?

In case of NEFT, a cancelled cheque with pre-printed name/copy of bank passbook with banker's attestation/banker's attestation on account details in surrender request. You may submit the surrender request with the above documents at nearby Max Life branch. Alternately, you may Click Here to submit your request online.

What is Neft form of LIC?

The payment under your policy/ies will be to be credited, directly to your Bank account through electronic mode of payment only. For this purpose, we require your bank details for making the policy payment through NEFT (National Electronic Fund Transfer).

How does Max Life Work?

It is a limited premium payment policy that provides life coverage up to the tenure of 25 years. After the completion of the premium payment tenure, the plan provides a guaranteed monthly income for 10 years. Moreover, the plan offers a comprehensive insurance coverage along with the rider benefit.

How do I change my bank account on Max Life Insurance?

Bank Details Updation 1Visit the nearest Branch and kindly carry the following documents: Service Request form. Original Pre-printed cancelled cheque. Bank Statement (If cancelled cheque is non personalized) Standard ID proof of Proposer. 2Once the required changes are done, the insurer will provide a confirmation.

How do I turn off auto debit in Max Life?

You can deactivate or remove the CCSI/ ECS with a written request duly signed by yourself (policy holder) and submitting the same at nearby Max Life Branch.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit max form on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing sir form pdf, you can start right away.

How do I fill out the electronic transfer mandate form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign sir form download and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out pdf sir form pdf on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your axis max life surrender form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is India Max Life Insurance Nationalized Electronic Funds?

India Max Life Insurance Nationalized Electronic Funds is a financial product or program designed to facilitate electronic transactions and manage funds associated with insurance policies under the India Max Life Insurance umbrella.

Who is required to file India Max Life Insurance Nationalized Electronic Funds?

Individuals or entities who hold a policy with India Max Life Insurance and are involved in transactions that require the movement or management of funds electronically are required to file India Max Life Insurance Nationalized Electronic Funds.

How to fill out India Max Life Insurance Nationalized Electronic Funds?

To fill out India Max Life Insurance Nationalized Electronic Funds, applicants must gather necessary personal and financial information, follow the instructions provided by the insurance company, and complete the electronic form ensuring all required fields are accurately filled before submission.

What is the purpose of India Max Life Insurance Nationalized Electronic Funds?

The purpose of India Max Life Insurance Nationalized Electronic Funds is to streamline the process of managing insurance-related transactions electronically, improve efficiency, and ensure timely and accurate handling of funds.

What information must be reported on India Max Life Insurance Nationalized Electronic Funds?

The information that must be reported on India Max Life Insurance Nationalized Electronic Funds typically includes policyholder details, transaction amounts, dates, purpose of the transaction, and other relevant financial data as required by the insurance company.

Fill out your India Max Life Insurance Nationalized Electronic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Max Life Insurance India is not the form you're looking for?Search for another form here.

Keywords relevant to max life easy pay form

Related to nationalized mandate form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.